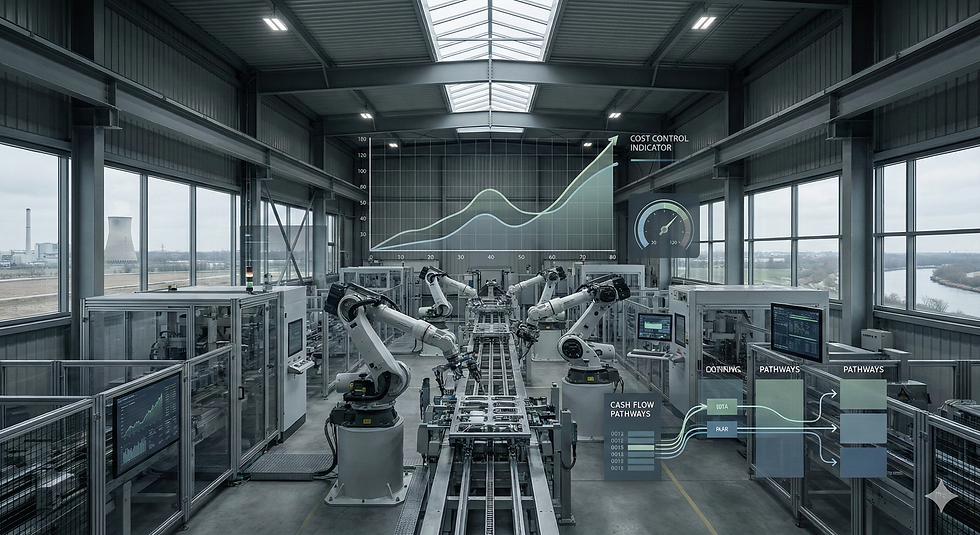

Cash Flow & Working Capital in Illinois Manufacturing

- Yash Sharma

- Dec 19, 2025

- 4 min read

Most Illinois manufacturers don’t fail during downturns.

They fail during growth.

Not dramatic failure.Not sudden collapse. But slow, quiet erosion—when cash tightens, flexibility disappears, and leadership realizes too late that operational success has outpaced financial control.

This is the uncomfortable truth about cash flow and working capital in Illinois manufacturing: the state amplifies stress faster than most operators expect.

The Working Capital and Cash Flow Problem in Illinois Based Manufacturing No One Likes to Admit

Illinois manufacturers operate with structural cash disadvantages compared to peers in lower-cost states:

Higher baseline labor costs

Larger fixed facility footprints

Older equipment requiring constant maintenance

Longer cash conversion cycles

These aren’t management failures. They are realities of operating here.

The mistake is pretending those realities don’t change how growth behaves.

In Illinois, growth consumes cash before it creates it—and if you don’t model that explicitly, your balance sheet will.

Why “Profitable” Illinois Manufacturers Still Run Out of Cash

One of the most common misconceptions we see is this:

“We’re profitable. Cash flow will catch up.”

That assumption is wrong more often than it’s right.

What actually happens in Illinois manufacturing:

Orders increase → inventory expands

Inventory expands → labor hours increase

Labor hours increase → overtime kicks in

Overtime kicks in → unit costs rise

Customers pay later than suppliers

At no point does revenue automatically turn into liquidity.

This is why manufacturing cash flow management in Illinois is not about bookkeeping—it’s about timing, sequencing, and elasticity.

Case Study: When Backlog Growth Quietly Choked Liquidity

An anonymized industrial equipment manufacturer in Northern Illinois saw backlog increase 35% over two quarters. Leadership interpreted this as a recovery milestone.

Operationally, they executed well.

Financially:

Work-in-progress inventory doubled

Supplier prepayments increased to secure materials

Overtime became permanent

Customer payment terms lagged production

Within six months, the company needed external financing—not because the business was weak, but because growth outpaced cash conversion capacity.

This pattern is extremely common in Illinois manufacturing cash flow challenges—and it is almost always predictable in hindsight.

Working Capital in Illinois Is Not an Accounting Metric — It’s an Operating System

Many Illinois manufacturers treat working capital as a reporting outcome.

Strong operators treat it as a design constraint.

They understand:

Inventory represents frozen decisions

Receivables represent deferred control

Payables represent negotiated trust

When working capital stretches too far, leadership loses optionality. Hiring pauses. Maintenance gets deferred. Customer commitments become riskier.

This is why working capital management in Illinois manufacturing must be proactive, not reactive.

The Labor–Cash Feedback Loop That Breaks Margins

Illinois labor markets don’t just affect cost—they affect cash.

In Chicago metro areas:

Labor competition forces wage acceleration

Turnover disrupts production flow

Downstate:

Hiring delays increase overtime

Training lag creates scrap and rework

What most manufacturers miss

Labor volatility doesn’t hit margins first. It hits cash flow first.

Overtime is paid immediately.Scrap ties up material.Rework delays invoicing.

By the time margins show damage, cash has already taken the hit.

Case Study: Labor Volatility That Looked Manageable on Paper

A Central Illinois food manufacturer believed labor costs were under control. Wage rates were stable. Headcount was planned.

What changed:

Temporary labor usage surged during peak runs

Yield dropped due to inexperience

Supervisory overhead increased

Labor cost per hour stayed near forecast.Labor cost per usable unit exploded.

Cash absorption increased by double digits before the P&L caught up.

This is why Illinois manufacturers who track averages instead of variability always get surprised.

Inventory Is Where Illinois Manufacturers Hide Risk

Inventory is often treated as a buffer.

In Illinois, it’s more often a liability disguised as safety.

Raw material stockpiles expand to protect lead times

WIP grows as scheduling complexity increases

Finished goods sit while customers delay acceptance

Each layer locks cash deeper into the system.

The companies that outperform do not chase lean dogma. They chase inventory intent—knowing why every unit exists.

The Forecasting Mistake That Makes Cash Problems Inevitable

Most Illinois manufacturers forecast revenue reasonably well.

Almost none forecast cash stress.

Static models assume:

Stable throughput

Predictable labor

Linear scaling

None of these hold consistently in Illinois manufacturing environments.

The result:

Forecasts that look accurate—but offer no warning.

This is why forecasting for Illinois manufacturers must include:

Cash sensitivity analysis

Labor elasticity scenarios

Inventory velocity assumptions

Anything less is reporting, not planning.

What the Best Illinois Manufacturers Do Differently

Across industrial equipment, food & beverage, metal fabrication, and advanced manufacturing, the strongest Illinois operators share the same behaviors:

They stress-test cash before scaling volume

They model labor as a variable, not a constant

They tie inventory decisions to liquidity, not comfort

They plan for volatility instead of hoping it doesn’t happen

This is the real foundation of Manufacturing in Illinois success—not optimism, but control.

Illinois Manufacturing FP&A Built for Cash Flow Reality

Most FP&A frameworks are built for stable, asset-light businesses.

Illinois manufacturing is neither.

At Total Finance Resolver, our FP&A work for manufacturers focuses on:

Cash flow stress-testing under real operating conditions

Working capital elasticity modeling

Labor-driven cash absorption analysis

Scenario planning tied to operational triggers

This is why our approach to FP&A for Manufacturing in Illinois resonates with operators and CFOs who have already felt these constraints.

We don’t add reports.We remove blind spots.

Stress-Test Your Cash Flow Before Growth Does It for You

We work with a limited number of manufacturing companies each month because this work requires depth, not volume.

If you want to understand:

How much growth your cash flow can actually support

Where working capital will break under pressure

Which labor scenarios create liquidity risk

Illinois manufacturing rewards leaders who design for strain—not those who react to it.

FAQs (Frequently Asked Questions)

1. Why do Illinois manufacturers struggle with cash flow during growth?

Because growth increases inventory, labor hours, and supplier commitments before customer payments accelerate, causing cash outflows to rise faster than inflows.

2. How does working capital impact manufacturing stability in Illinois?

Working capital determines whether manufacturers can absorb labor volatility, inventory buildup, and supplier pressure without sacrificing operational control.

3. What role does labor volatility play in cash flow problems?

Labor volatility increases overtime, scrap, and rework costs, which absorb cash immediately while revenue recognition often lags behind.

4. How can Illinois manufacturers improve cash flow predictability?

By stress-testing cash flow under realistic labor, inventory, and demand scenarios instead of relying on static forecasts.

Comments