Outsourced FP&A Pods for Venture-Backed Startups

"Don't hire a solo Fractional CFO. Get a 3-person finance team."

Venture-backed founders often lock themselves into high fixed costs too early. Total Finance Resolver replaces the traditional $180k+ hire with a modular, investor-grade FP&A Pod.

Unlike a traditional Fractional CFO who only provides high-level strategy, or a generic Outsourced FP&A service that only delivers spreadsheets, an FP&A Pod is a dedicated, multi-disciplinary team that integrates strategy, compliance, and execution into one agile unit.

Strategy Engineered by Alumni

Goldman Sachs • JP Morgan • Big4 • McKinsey • Bain

The Real Cost : In-House vs. Outsourced FP&A

-

Most Series A startups cannot afford a full-stack finance team, yet they need the rigor of one.

-

The Traditional Path: VP Finance + Senior Analyst = $300k/yr + Equity.

-

The TFR Pod: You get a Strategist (CFO), Controller, and Analyst for 60% less.

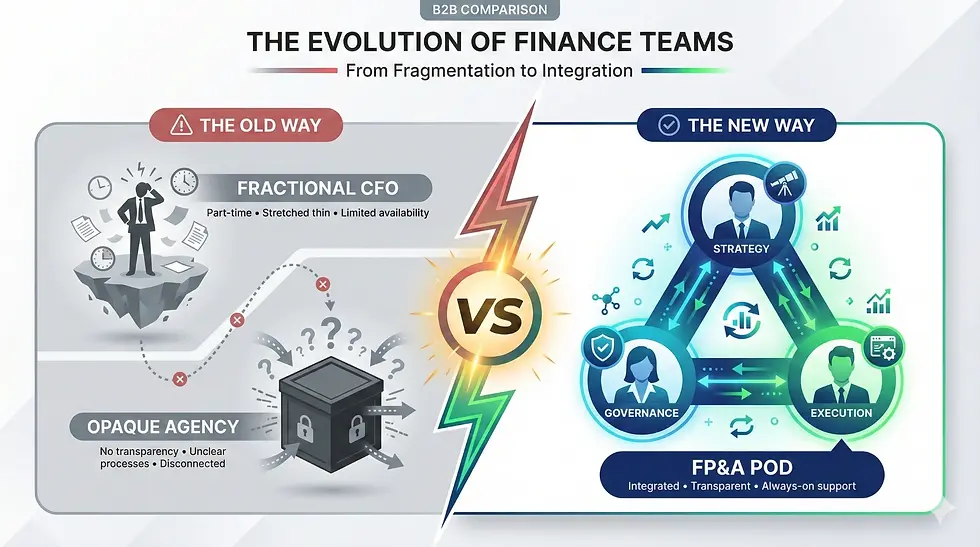

Why the Traditional "Fractional CFO" Model Is Broken

Most founders fall into one of three traps when trying to scale their finance function.

The Overworked Fractional CFO

You hire a Fractional CFO expecting a transformation. But they are split across 10 clients.

Strategy without execution is hallucination.

The "Inexperienced" In-House Hire

You hire a junior Finance Manager. They are diligent but lack the strategic weight for Series B raise.

You pay full-time salaries for junior output.

The "Black Box" Outsourced FP&A Agency

You send data out; you get a report 30 days later. No context, no agility, and no integration with your ops team.

Finance becomes a bottleneck.

What is Outsourced FP&A (The Pod Model)?

An FP&A Pod is a dedicated finance unit that replaces the "lone wolf" hire. Instead of relying on a single Fractional CFO, a Pod integrates Strategy, Governance, and Execution into one agile team for a single monthly fee.

Think of it as "Fractional Finance Done Right." In the traditional outsourced FP&A model, you get a slice of a person's time. In the Pod model, you get a slice of an entire department.

This structure eliminates the single point of failure. If your CFO is in a board meeting, your Controller is still closing the books. If your Controller is auditing, your Analyst is still updating the dashboard. The FP&A Pod ensures your finance function is "Always On," scalable, and redundant.

What FP&A Pods Replace?

The Anatomy of Your FP&A Pod: 3 Roles, 1 Outcome

A Fractional CFO is too expensive for data entry.

An Analyst isn't qualified for board strategy. The Pod deploys the right talent for the right task.

The Architect

CFO LEVEL STRATEGIST

They act as your strategic partner for M&A, board decks, and cash burn management

KEY OUTCOME: SERIES A PREP

The Guardian

CONTROLLER LEVEL

Trained in the world's strictest audit environments to ensure your month-end close is bulletproof and GAAP compliant.

KEY OUTCOME: AUDIT READY

The Engine

SENIOR ANALYST LEVEL

The "kill-skill" execution layer. They build the 3-statement models and live dashboards used by Private Equity firms to evaluate exits.

KEY OUTCOME: LIVE DASHBOARDS

The 4 Models of Modern Finance: Why Pods Win

In the high-stakes world of venture-backed growth, the wrong choice costs more than just a salary—it costs you momentum. Here is how the FP&A Pod stacks up against the Fractional CFO, the Talent Marketplace, and Traditional Outsourcing.

Who are FP&A Pods Built for?

FP&A Pods™ are built for venture-backed SaaS / AI and AdTech / Fintech founders operating in California, New York, Texas, Illinois, and Washington who need investor-grade financial clarity without expanding headcount.

Built by Operators Who Prepare Companies for Institutional Capital

-

Experience with venture-backed SaaS

-

Exposure to investor expectations

-

Focus on decision-grade FP&A

Context is Currency. We Know Your Market.

Generic finance teams treat every dollar the same. We don't.

Running a SaaS company in Silicon Valley (High Burn / Valuation Focus) is a different sport than running one in Austin (Profitability / Tax Focus).

We are not general infantry. We are Special Forces Units deployed with specific mission parameters for your exact geography and sector.

The SaaS Stack ( CA, TX, WA )

Optimized for Venture-Backed SaaS & AI. We focus on managing High Burn Rates, R&D Tax Credits, and Series B Valuation metrics for Bay Area investors.

The NYC Stack ( Fintech & AdTech)

Built for the fast-paced New York Fintech ecosystem. We track CAC/LTV efficiency, media spend reconciliation, and regulatory compliance.

The Industrial Stack ( Illinois )

Physical products require physical discipline. We handle complex inventory tracking, COGS analysis, and supply chain forecasting.